Types Of International Spot Silver

In the investment world, silver investment is also gradually coming into the view of investors due to the lower threshold of international spot silver investment than gold.

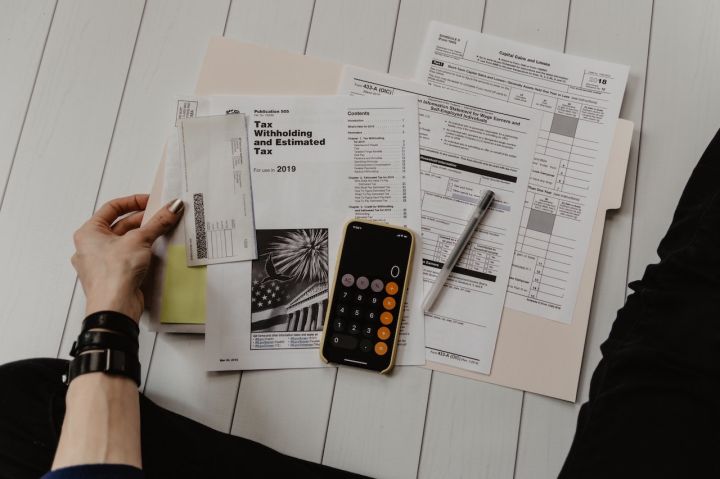

In The Us, Money Market Funds Can Be Classified Into Several Categories According To Their Riskiness

In the United States, money market funds can be divided into three categories according to the level of risk. In the United States, money market funds can be divided into three categories according to the level of risk. 1, Treasury bill money market funds, which invest mainly in treasury bills, marketable securities guaranteed by the government, etc. These securities generally have a maturity of less than one year, with an average maturity of 120 days. 2,Diversified money market funds, which are commonly referred to as money market funds, usually invest in a variety of marketable securities such as commercial paper, treasury bills, securities issued by U.S. government agencies, negotiable certificates of deposit, bankers' acceptances, etc., which have similar maturities as the aforementioned funds. 3, Tax-exempt money funds, which are used primarily for short-term financing of high-quality municipal securities, also include municipal medium-term bonds and municipal long-ter

What Is Gold Margin Trading

In the current world of gold trading, there are both gold futures margin trading and gold spot margin trading.

Six Signs Of The Financial Crisis And Its Precursors

Six manifestations of the financial crisis

Stock Market Manipulation Must Know The Secret

Intraday chart research to determine the best selling point

What Is The Procedure For Buying Open-End Funds?

Open-end Funds refers to listed open-ended funds that can be purchased and redeemed at designated outlets or bought and sold on the exchange after they have been issued.

Forex Operating Principles

The only way to make consistent profits is to keep your mistakes to a minimum. Keeping the following points in mind will help to help you make steady profits over time and reduce the risks involved in forex.

What Does a High Stock Turnover Rate Indicate?

A high turnover rate indicates that: the stock has a low lock-up rate.

ntroduction To The Development Of The Global Options Market

Early options trading in the US began in 1872, founded by the then famous financier Russell, and at that time included call and put options, the market was always OTC and required trading through brokers.

Six Tips For Open-Ended Funds

Open-ended funds, also known as mutual funds abroad, together with closed-end funds, constitute the two ways of operating a fund.